Nicole Rawling, Co-Founder and CEO of Material Innovation Initiative was recently joined by Elaine Siu, Advisor to MII and researcher into new industries incubation, for a webinar looking back at the state of the next-gen materials industry in 2023, following our latest publication in this series of annual reporting. Nicole and Elaine shared valuable insights on this topic and answered intriguing questions from attendees.

Key areas covered in this webinar include a discussion of recent events concerning failures in the industry, the investment highlights of 2023, and the innovation hype cycle.

For more information on the state of the next-gen materials industry, download the report here.

Recent Industry Events

Renewcell’s Bankruptcy

At the time of the webinar, Renewcell’s bankruptcy was fresh in the headlines. Nicole called the general reaction somewhat “overblown”, and reminded us that most new technologies and industries have failures, often in the form of risk-taking first-movers.

“Just because one company fails, [it] doesn’t mean that the industry is not viable, or that there’s not demand for next-gen materials”

– Nicole Rawling, Co-Founder and CEO of Material Innovation Initiative

It’s important to remember that, unfortunately, sustainability alone is not enough of a unique selling point for material companies. There has to be a business case for the innovation to succeed, otherwise fashion brands will not use the product. Nicole recommended Brooke Roberts-Islam’s recent reporting on this dynamic regarding the Renewcell news.

Material Science Done Right

Entrepreneurs and material companies in development should look at the desired end goal and ask “What do we need? And what’s the best way to create that?”

Nicole made a case for “material science done right” – which she describes as investors, entrepreneurs and material companies in development taking a big picture look and asking the right questions. They should look at the desired end goal, and ask “What do we need? And what’s the best way to create that?”. She says this will lead to more beneficial outcomes than simply looking at what is right in front of us, e.g. textile waste, and asking “What do we do with this?”.

Download our White Space Report 2021 for more on this topic and sign up to our newsletter to be notified of our upcoming White Space Report later this year.

Are Brands To Blame For Failures By Not Buying From Material Innovators?

There have been comments in the press that there is a lack of urgency and support from brands towards innovators like Renewcell. Do brands have an obligation to buy from them and prevent these failures?

Yes, they do, said Nicole, but not for the reason you might expect. Brands, at the end of the day, are obligated to make money for their shareholders, not to have a positive impact (unless they are a B Corporation.) And they make money by fulfilling their consumers’ desires, which increasingly, demand sound sustainability practices. Therefore, brands are obliged to support sustainable initiatives, not necessarily because it’s good for the environment, but because it’s a good business decision. “That is the core of making a business sustainable to … be competitive in those basic parameters that … drive whether a consumer is going to buy something or not,” Elaine agreed.

Are Consumers Still Backing Next-Gen Materials?

Consumer research is an art and a science, said Nicole. Consumers may convey how they would like to perceive themselves and not how they will actually act in a purchase situation. Nevertheless, how consumers think about themselves and what they want to be able to purchase in the future is important. And in that future, next-gen materials have a very strong stance, Nicole emphasized.

Here are some of the exciting figures our research has revealed on U.S. consumers:

- 92% of survey participants stated they were at least somewhat open to purchasing next-gen materials, of those, 41% are extremely likely to purchase.

- About ¾ (78%) would pay the same or more, including about ⅓ (29%) would pay a slightly or much higher price.

The numbers for Chinese consumers were even more favorable (these concern next-gen leather in particular):

- 70% reported a high likelihood of purchasing.

- 90% reported a preference for next-gen leather over conventional leather.

- 62% of early adopters for next-gen leather would be willing to pay more for it.

- For standard consumers, 57% would pay more.

Nicole was quick to note that all of these are unusually high numbers for consumer interest in new technologies.

Brands: Consider Investing in Next-Gen Materials

Nicole urged brands to invest in next-gen materials, as it solves solves common problems, namely:

- It provides the benefit of brands being able to own and understand more of their supply chain

- It provides exclusive access to the material since they own it.

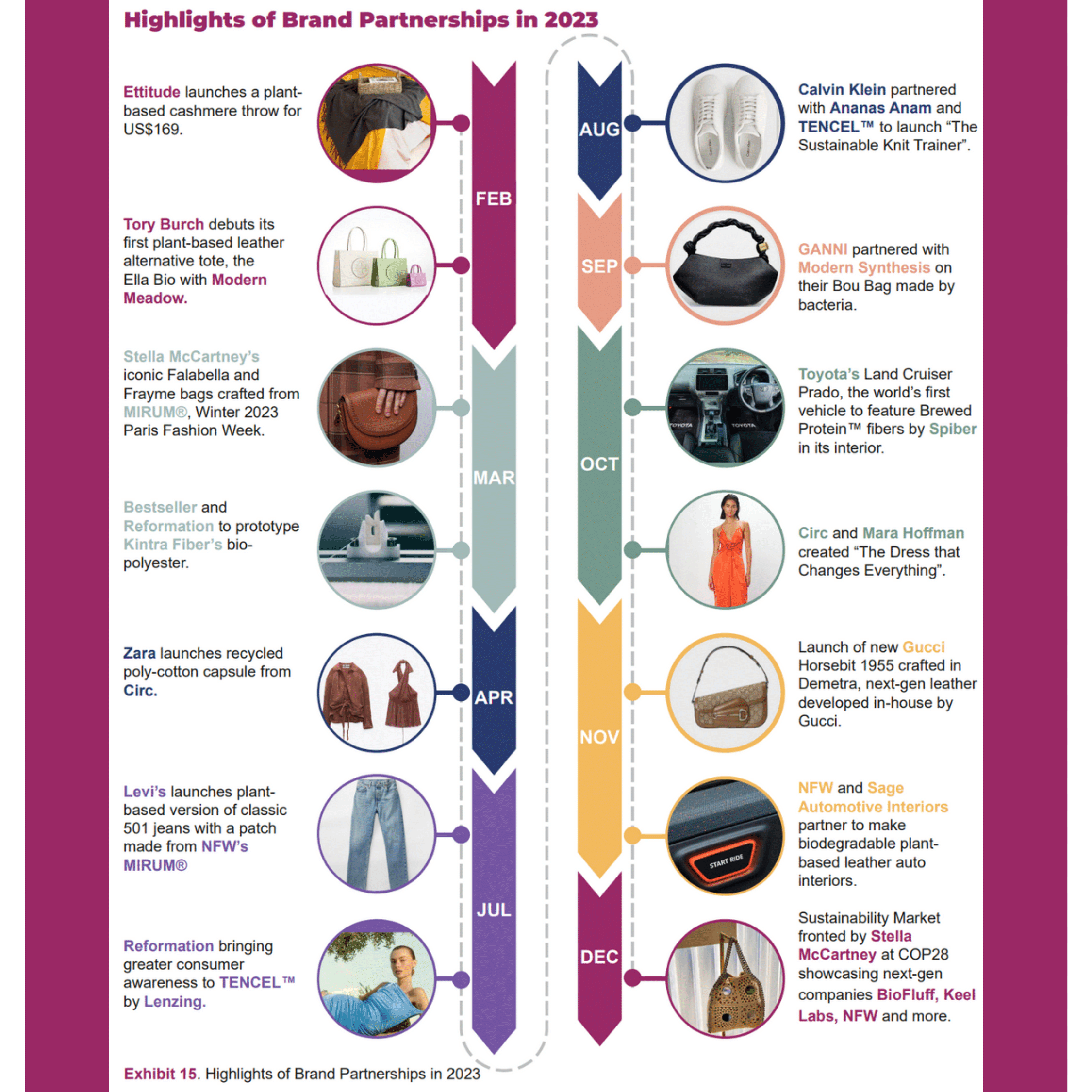

- An example of this is Demetra, Gucci’s in-house next-gen leather that they launched last year in a campaign fronted by musician Billie Eilish.

There is also space for government investment with next-gen materials. This can help an industry really take off, as has happened with EVs, for example. “Public funding is very, very powerful,” agreed Elaine. Excitingly, MII is currently working with a U.S. congressperson to introduce a bill to direct investment towards next-gen materials.

Investment Highlights of 2023

Funding and Investment

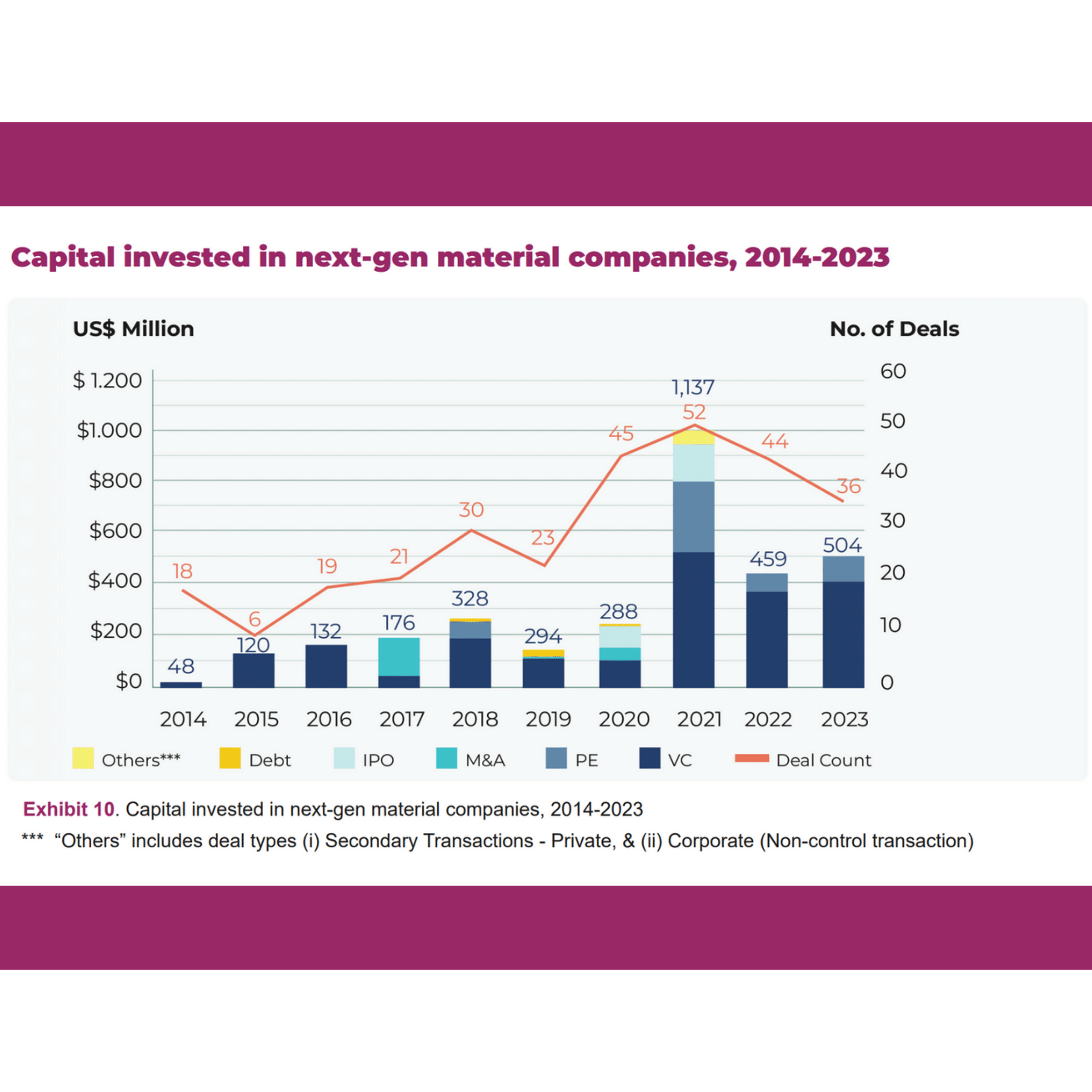

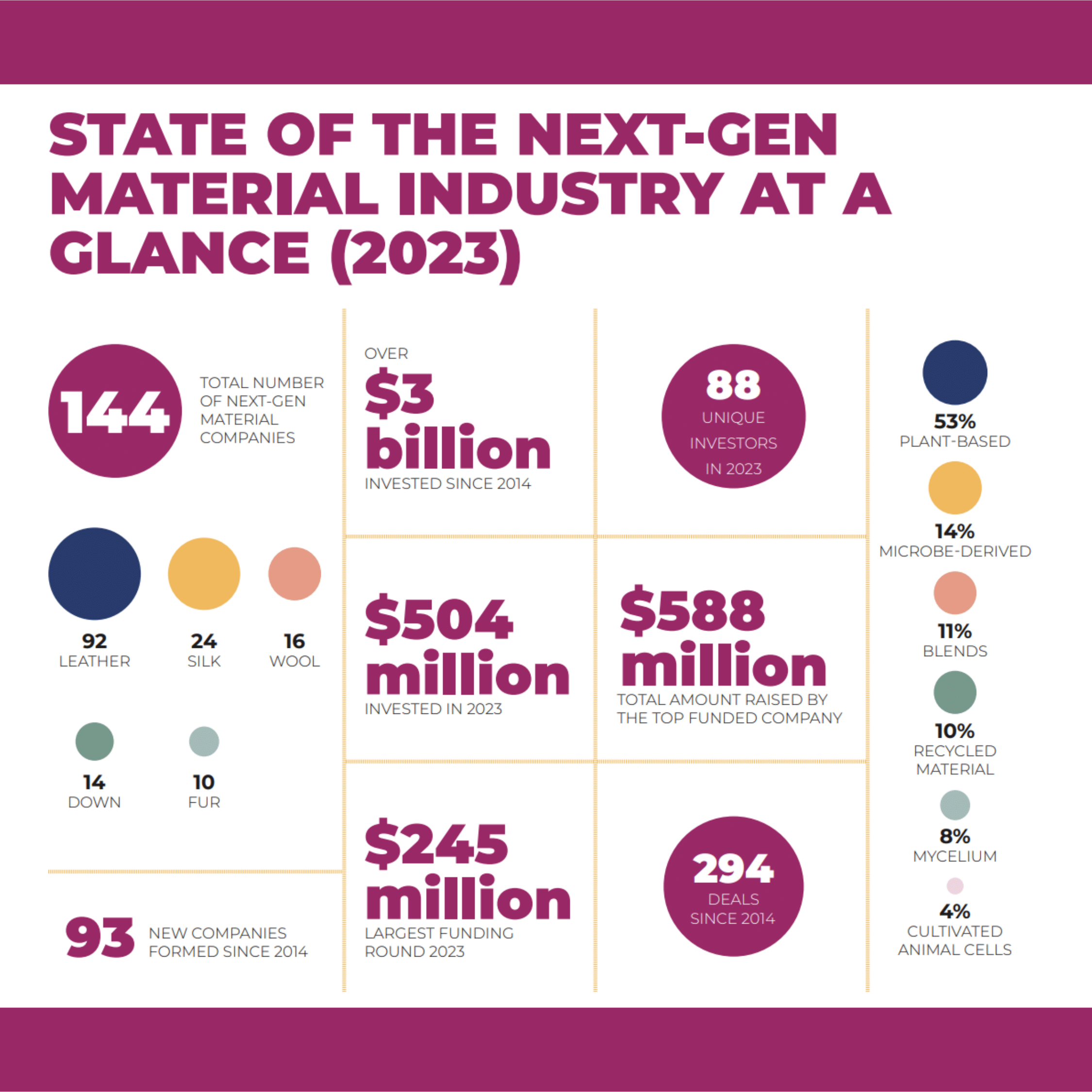

“The global VC funding scene has not been doing well at all,” Elaine warned, however, for next-gen materials there was “good news and honestly I was pleasantly surprised when we were looking at the data”. There was a 42% decrease in VC funding globally and deal count fell 30% in 2023 to reach a six year low. Despite this, the next-gen materials industry had a 10% increase.

“This is genuinely good news for the next-gen materials market”

– Elaine Siu on the increase in investment against a global backdrop of decreases.

She went on to show the funding history of the top 10 next-gen material companies. “It’s useful to put things in context and look at the top funded companies, how much has actually gone into (them) … It’s important to dig into the details when looking at news [of the industry],” she said.

An Upward Trend After 2021’s Spike

Elaine demonstrated how we are starting to see an upward trend again after 2021’s spike. “In hindsight, that is abnormal, and was that going to be a sustainable [rate of] growth?” she questioned.

Fresh Perspectives on The Hype Cycle

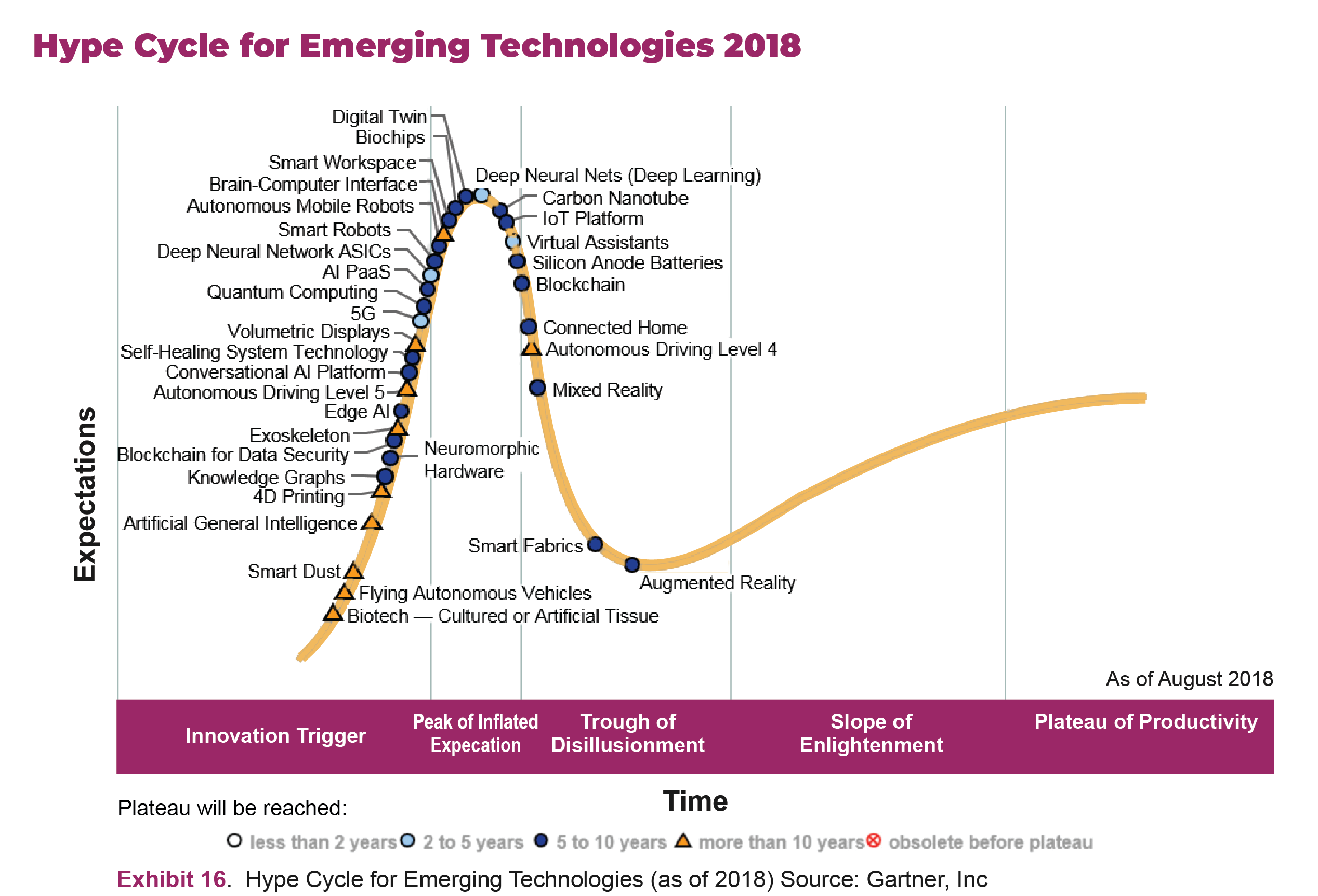

In the report we looked in-depth at the Gartner Hype Cycle theory for innovation. This charts the likely trajectory for emerging industries and technologies. There are 5 stages to the theory: the innovation trigger, the peak of inflated expectation, the trough of disillusionment, the slope of enlightenment, and the plateau of productivity. A technology or industry reaches maturity in the last stage.

Elaine explored this in the webinar related to the next-gen materials industry:

- The innovation trigger was around 2018-2019 when a lot of new companies emerged.

- In 2020-2021 the industry hit the peak of inflated expectation, corroborated by the steep spike in investment seen in the graph above. Next-gen materials were a hot media topic and investors seized the opportunity to add a next-gen company to their portfolio. Brands were also getting excited about the possibilities. Innovation was pushed to its limits, but it could only go so far at that time, and so…

- After all that hype, and a collective impatience that didn’t want to wait for the slower rate of innovation, in 2022 the industry slid into the trough of disillusionment. Negative press emerged, greenwashing claims arose and “the innovation was discredited for not living up to this over-inflated expectation of being perfectly sustainable and, basically, [not] getting to market tomorrow” Elaine elucidated.

- The industry now appears to be edging towards the start of the slope of enlightenment, and we go into more detail on this in the report.

Brand Engagement Highlights from 2023

A number of exciting partnerships and in-house developments are highlighted in the report, below is just a taste of the most notable from 2023:

Q&A

A lively Q&A session followed, with questions such as:

- How can startups move from prototype to pilot?

- Are there jobs for scientists in this industry? (yes!)

- What is the best next-gen material?

- Where does marketing come into the success of next-gen materials?

- What do we need more of here – designers or scientists?

Use the video chapters in the recording above to navigate to the finishing Q&A section.

More Key Points from the Report

For more information on the state of the next-gen materials industry, download the report here.

Here are some additional exciting points from the report:

- Multiple new sustainability laws and regulations are coming into force globally that are putting pressure on brands to make real sustainability commitments. The biggest of those brands will become the buyers that create the most demand for next-gen materials. which will further accelerate the industry.

- At the end of 2023 there was an upward trend in investments in the next-gen materials industry. This is a sign that the industry may come out of the Trough of Disillusionment faster than might be expected.

- Industry brands can play multiple important roles in the ecosystem, including funding both internal and external innovation initiatives, switching to next-gen materials as their raw materials, and collaborating with next-gen material startups to create new products. All this leads to acceleration of commercialization and scale-up production of next-gen materials to replace their conventional counterparts.

To attend our future webinars, check out our upcoming events here.