Wondering what we mean by “white spaces” in the context of next-gen materials? See our explainer blog post.

As demonstrated in our State of the Industry Reports over the last four years, the next-gen materials industry continues to see increases in the number of innovators and investments in this space. However, of the current total of 144 material innovators, 92 of them are innovating in next-gen leather. That means the remaining third or so of innovations are split across four subcategories: silk, wool, down, and fur. It is clear that these relatively neglected categories are white spaces in and of themselves.

In the first in our series of reports, covering each of the seven critical white spaces, we focus on the under-served categories of next-gen silk, fur, wool and down. In this post, we summarize all the key points from the report. If you find this information of value, be sure to download the full report where we go into more detail on everything covered here.

Sub-category with limited innovation: Silk/Polyester

For in-depth information on next-gen silk, see our What Makes Silk, Silk? Reports: Original and Revisited.

Image credit: Orange Fiber

Market Potential

The total addressable market size for next-gen silk is significant, with the global silk market being valued at around USD 20 billion in 2024 and projected to be worth USD 44.6 billion by 2034.

Technologies for next-gen silk and next-gen polyester overlap, so entrepreneurs, investors, and innovators looking to recreate silk should also look to the polyester market, and vice versa, as part of the total addressable market. The polyester market has seen considerable growth in recent years. Its market size was estimated at USD 118.5 billion in 2023 with projections of it reaching USD 160 billion in 2032.

Uniqueness: What makes silk so special?

Silk is peerless among natural fiber textiles due to its smooth, continuous filament. This lends silk yarn its celebrated properties of strength, elasticity and resistance to pilling. The high luster or “shine” of silk is also a standout feature. It absorbs natural, nontoxic dyes easily, imparting vivid colors to its fabrics. Its protein-based composition makes it adaptable to different environments and thus an all-weather fiber. Silk can be diverse, with textiles coming in a variety of weights, hands, sheens, drapes, and sounds.

Innovation Potential: How can silk be improved?

Image credit: Kevin Winter/WireImage

Many woven silks are delicate, requiring careful cleaning to avoid shrinkage from machine washing. Furthermore, they attract static, have poor UV resistance and low long-term heat resistance, meaning that ironing can degrade them. Despite its high strength, the fine nature of silk filaments and their use in thin fabrics can make them susceptible to damage like snags. Most notoriously, silk has a relatively high cost compared with cotton or synthetics and is therefore often reserved for luxury apparel and accessories.

Key targets for creating silk alternatives

Silkworm silk fiber possesses several desirable attributes, including strength, elasticity, resistance to pilling, and smooth, translucent fine fibers that contribute to uniform, high-quality fabrics that take dyes well, resulting in vibrant, non-toxic colors.

Silkworm silk fabric carries all of the above desirable qualities and more. It can be woven in various ways to achieve different textures and drapes, such as taffeta and sateen. The unique movement and sound qualities, like “scroop,” “glissade,” and “flutter,” are markers of its quality.

Improvement potential targets for silk

Key improvement targets range from decreasing the environmental footprint and bypassing harm to animals, to increasing UV resistance, launderability, and durability to state just a few examples.

Sub-category with limited innovation: Fur

For in-depth information on next-gen fur, please see our What Makes Fur, Fur? Report.

Image credit: Ecopel

Market Potential

The total addressable market size for next-gen fur is significant, in part due to public opposition to animal-based fur and related bans, leading to a decline in global fur production from 140 million animals in 2014 to 42 million in 2021. Although synthetic furs have environmental concerns, public awareness is low, driving market growth. Valued at USD 25 billion in 2022, the synthetic fur market is expected to grow at a CAGR of 8.8% from 2023 to 2031.

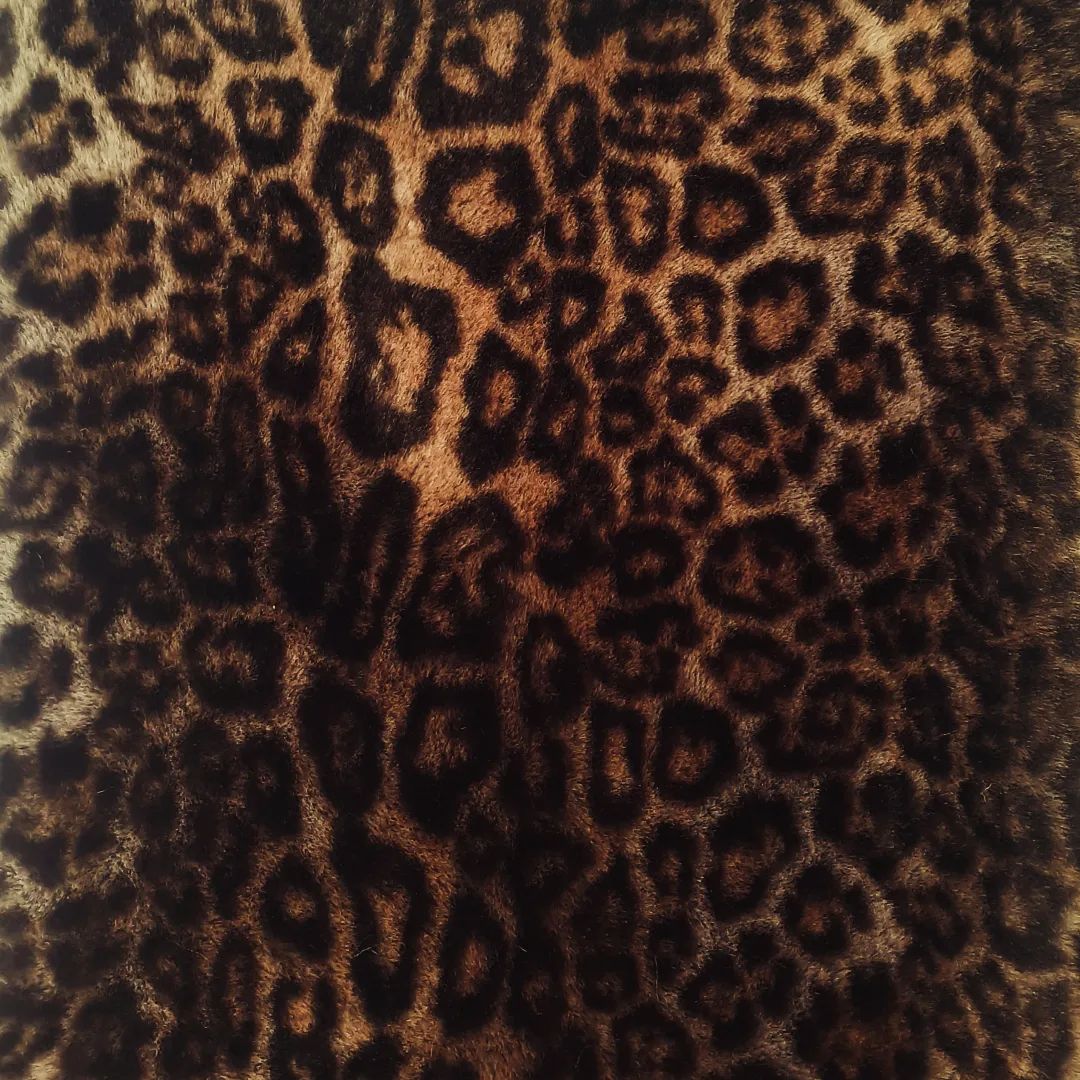

Uniqueness: What makes fur so special?

Fur is multi-layered: both physically and conceptually

Fur is a unique material from both a design and scientific perspective. It has a wide diversity of applications in terms of the many types of products it can be used in, from coats to keychains to rugs. It is also one of the few materials which can simultaneously conjure images of luxury and rusticism. Humans are drawn to fur, perhaps more than any other material, we often have an involuntary urge to touch it. But how people perceive fur varies widely, for some it’s the height of luxury while for others it represents the ultimate human disregard for animal suffering.

Fur has a variety of aesthetics and hand-feels

Animal-based fur comes from a variety of animals and produces various colors, textures, and hand-feels. Animal fur is special due to its complexity and multi-layered structure.

Fur is highly customizable. It can resemble the animal’s original coat or be dyed in both “natural” and bright fashion colors. Patterns can be created through patchwork, using multiple colors, changing hair direction, or trimming.

Fur’s functionality and structure

Fur is one of the most thermally insulating animal-based materials, providing warmth and dryness to the wearer. While animal fur is naturally flame retardant due to its protein-based fibers, synthetic fur often requires additional flame retardants.

Innovation Potential: How can fur be improved?

Animal-based fur production involves inhumane conditions, cruel slaughter methods, and inefficiencies in sourcing and manufacturing. Farmed animals require extensive resources for breeding, care, feeding, and slaughter, while wild-trapping involves labor-intensive processes. Significant waste occurs as furriers aim for consistent patterns and color, with many parts being unusable. These animals also pose public health risks, as seen in the Covid-19 pandemic, due to their potential as zoonotic disease incubators.

Image credit: Ecopel

Moving towards plant-based sources can eliminate these risks, offering opportunities to innovate fur’s thermal properties and durability beyond biological constraints. Animal fur is high maintenance, requiring specialized care, unlike next-gen fur which promises reduced maintenance needs and seasonless applications. Contrary to perception, animal-based fur depreciates over time and is not a sound investment, whereas next-gen fur can be manufactured efficiently to meet various price points.

Key targets for creating fur alternatives

For next-gen fur to be successful, it needs to improve upon the existing material. While all next-gen furs should (by definition) have a lower environmental impact without the animal-cruelty, these factors alone are not sufficient for success. Next-gen furs must also improve on the performance attributes of fur and be cost-competitive.

Key environmental targets include using mostly bio-based or recycled inputs, making products recyclable or biodegradable, minimizing microfiber shedding, using green chemistry for dyes and treatments, and reducing carbon emissions, water use, and land use during production.

Tunability and variety are key

To be successful innovators must be able to offer a portfolio of fur product offerings for adoption by brands. Animal-based and synthetic furs have a wide variety of colors, prints, patterns, textures, and lengths. Next-gen materials will need to meet this variety of options but also have the potential to expand beyond, akin to the novel colors and textures offered by current-gen synthetic fur.

Sub-category with limited innovation: Wool

Image credit: ettitude

Market Potential

The technologies used to create next-gen wool, acrylic, and polyester overlap, so entrepreneurs, investors, and innovators looking to recreate wool should also look to the acrylic and polyester markets, and vice versa, as part of the total addressable market.

The acrylic fiber market is estimated at USD 2.7 billion in 2024, but is expected to decline to USD 2.4 billion by 2029, this could be due to strict global regulations on its production and the readily available alternative of polyester.

The global wool market size is expected to grow from USD 39 billion in 2024 to USD 49 billion by 2028.

Uniqueness: What makes wool so special?

Wool’s versatility spans from luxurious to utilitarian applications, with varying fiber lengths, textures, and colors derived from different animal origins. It offers contrasting hand feels, from super soft to coarse, and has become suitable for year-round wear. Coarser yarns provide a sense of protection, while cashmere evokes a luxurious feel.

Wool’s unique structure gives it exceptional performance properties such as insulation, moisture-wicking, odor resistance, durability, wrinkle resistance, flame resistance, and biodegradability, making it a multifaceted material with a deep-rooted emotional appeal.

Innovation Potential: How can wool be improved?

Wool faces numerous practical issues such as being scratchy, pilling, and requiring high-maintenance care. Wool also contributes to significant environmental issues such as high GHG emissions, water use, chemical use, and hindering biodiversity. Animal welfare issues, such as painful live lamb cutting (mulesing) and high lamb mortality and slaughter, persist. Next-gen alternatives offer the opportunity to mitigate or solve all of these problems.

Image credit: KD New York

Key targets for creating wool alternatives

While next-gen wool should (by definition) have a lower environmental impact without the animal-cruelty, these factors alone are not sufficient for success. Next-gen wool must also meet the performance attributes of wool and be cost-competitive.

Wool can be improved upon in its next-gen realization across six key target categories.

Environmental Targets

Focus on key areas such as recycled or biobased material inputs, end-of-life considerations, mitigating microfiber release, green chemistry for additional components, and environmental impact reductions.

Tunability and Variety

It is critical for next-gen wool innovators to understand that to be successful they will need to offer a portfolio of yarns or finished textiles to brands. Animal-based and synthetic wools have a wide variety of colors, prints, patterns, textures, and lengths.

Eliciting Emotions

Wool products are known to appeal to human emotions and conjure up expectations – like warmth or protection. Focus on optimizing the qualities that affect our emotional responses, such as color, surface texture, drape and hand feel.

Wear, Care and Laundering

Anything that makes caring for a product—whether it is a blanket or apparel—easy and economical is a win for the consumer. Machine washability, lack of shrinkage and pilling are some key priorities here, among others.

A Variety of Applications

Wool, wool blends, and acrylic offer a wide range of options for diverse markets and uses, from home goods and furniture upholstery to apparel, footwear, and accessories. Innovators should explore these versatile applications while considering regulatory requirements like flame retardancy where necessary. Wool historically dominated the outdoor apparel market before the rise of acrylic and nylon, highlighting its enduring potential in this sector.

Brand and Manufacturing Partners

It is important to develop yarns that drop into the existing supply chain. Working with a brand is crucial to get feedback on various aspects of your materials in different applications. Also aim to work with a mill or textile manufacturer to ensure your yarn will work in the existing equipment and to help you troubleshoot common issues.

Sub-category with limited innovation: Down

Image credit: Ponda

Market Potential

When we look at the market size for next-gen down, we also should consider polyester fill as an addressable market. The technologies used to create next-generation down and polyester fill are overlapping.

The total addressable market size for next-gen down is significant. The global down and feather market is estimated at USD 1.7 billion in 2024 and is expected to reach USD 2.4 billion by 2029. Other sources estimate that the market may reach a significantly higher value of USD 16 billion in 2030.

Uniqueness: What makes down so special?

Down, the soft undercoating of feathers from ducks and geese, and polyester fill, a synthetic and hypoallergenic alternative, are prized for their insulation and comfort. They are used widely in bedding, apparel, outdoor gear, cushions, and luxury linens. Down’s three-dimensional structure traps air for lightweight warmth and breathability, while polyester fill offers affordability and hypoallergenic properties. Both materials come in various weights, suitable for year-round insulation needs.

Polyfill versus Down

Polyfill offers several advantages and a few disadvantages when compared to down fill. It is more hypoallergenic, easy to care for, affordable and resilient, but also less breathable and heavier than down, and polyester production has significant negative environmental implications. Innovators should consider the practical advantages of polyfill and try to meet or exceed these qualities.

Innovation Potential: How can down be improved?

3.4 billion ducks and geese are slaughtered every year in the down and feathers industry, a conservative estimate for their use in fashion only. Live plucking is a common practice on factory farms in the major down-producing countries. Ducks and geese, although being aquatic animals who have not evolved to support their weight for extended periods on their legs, are confined to land-based farms. Down production’s negative environmental impact includes water and air pollution, high water usage, habitat destruction, and the risk of zoonotic diseases such as Avian Flu.

Both down and polyfill also have performance and care drawbacks. For down, for example, it’s the inconsistency in quality and therefore performance, special laundering requirements, and lack of natural water resistance. For polyfill, heat build-up and low moisture absorbency could be improved.

Image credit: Risto Kirjonen x Fluff Stuff

Key targets for creating down alternatives

Environmental

Focus on these key areas: recycled or biobased material inputs, end-of-life consideration, mitigating microfiber release, green chemistry for additional components, and environmental impact reductions across key categories.

Tunability and Variety

To meet brands’ needs, innovators should offer various weights, thicknesses, and densities to meet the range of applications next-gen down can cater to.

Wear, Care and Laundering

Machine wash-ability and dry-ability, being hypoallergenic, and biodegradable or recyclable at end-of-life are some desirable improvements for down, among others.

A Variety of Applications

Consider a variety of applications across home goods, outerwear, footwear, accessories, children’s products and the auto industry.

Image credit: von Holzhausen

Brand and Manufacturing Partners

Working with experienced fill manufacturers directly or through a brand’s supply partner will take away the guesswork of knowing if your material is viable. They can provide invaluable early feedback in your developmental stage, ultimately hastening your road to scaling and brand adoption.

Next-gen silk, fur, down, and wool are untapped white spaces with room for much more innovation compared to the burgeoning next-gen leather industry. Brands and consumers are looking for innovation in these areas to provide environmentally preferable, animal-free solutions to harmful incumbent materials. “Like any blank canvas, white space can provoke fear and hesitation.” But taking on these challenges will enable the next-gen materials industry to deliver on performance and aesthetic and to protect our planet and its inhabitants.

Download our first white space report, on sub-categories with limited innovation, freely available now.