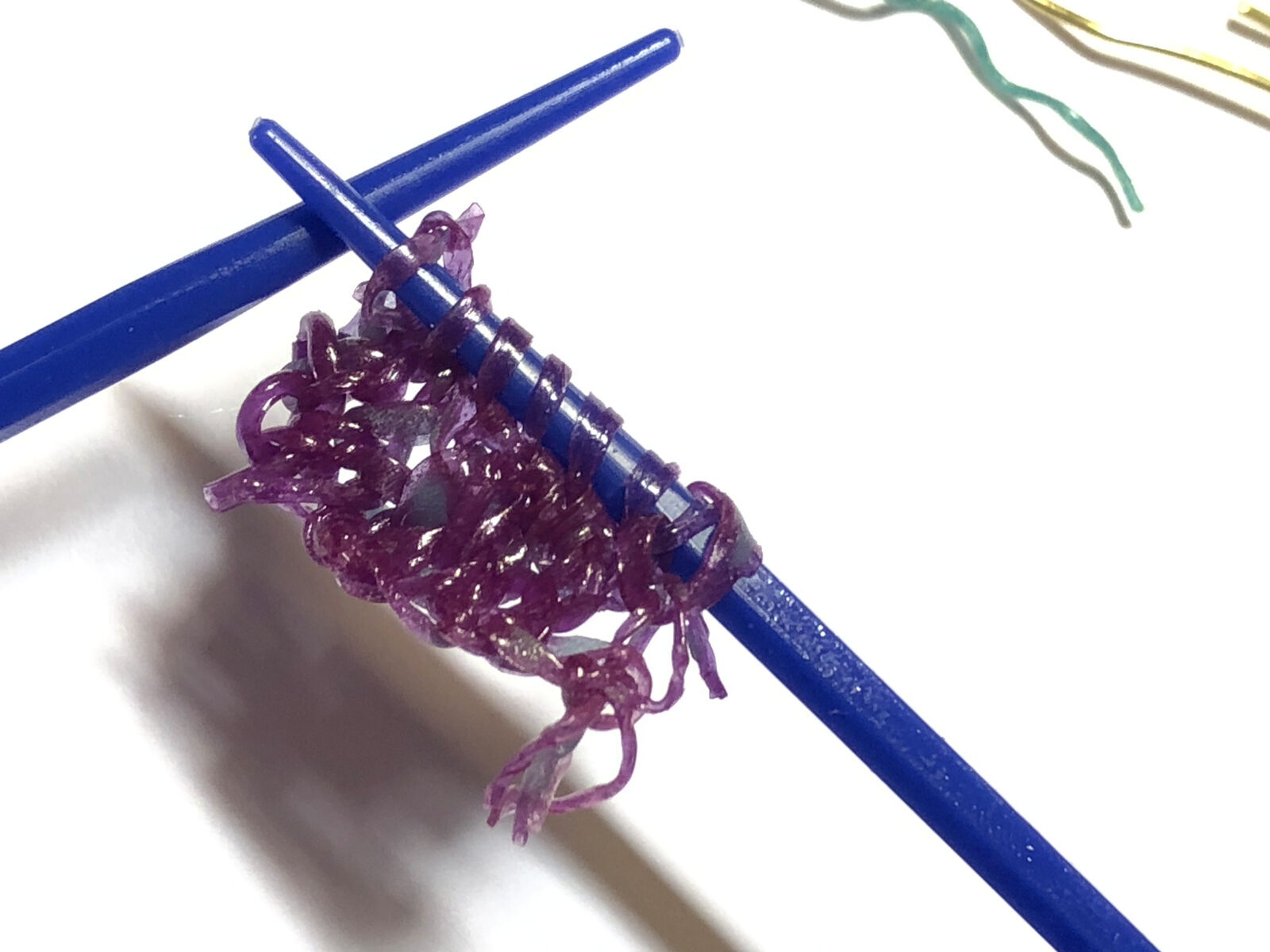

Image credit: Ryan Duffin for Keel Labs

At the Material Innovation Initiative (MII), we use the term white space to refer not only to areas without current competition, but also to new technology and gaps in existing markets. We identify seven key areas with significant opportunities for innovation in the next-gen material industry, broadly defined. We first mapped out these seven white spaces in our 2021 report, produced in collaboration with The Mills Fabrica. Now we’re revisiting this topic to further chart the landscape for you by publishing a new report on each of the seven key white spaces, beginning June 2024. In this new mapping process we seek to look at the material landscape up and down the value chain with a new lens. We want to identify unmet and unarticulated needs. These are not only missed opportunities but often also barriers to the growth and adoption of next-gen materials. We need to direct interests, attention, and resources to fill these gaps for the benefit of accelerating the entire next-gen materials industry.

Whether you are a material startup looking for high-growth opportunities, a scientist developing a new technology or material, a brand looking for the future trends and needs of sustainable products, or an investor thinking of strategically diversifying into next-gen materials, learning about the seven critical white spaces will help inspire your next move.

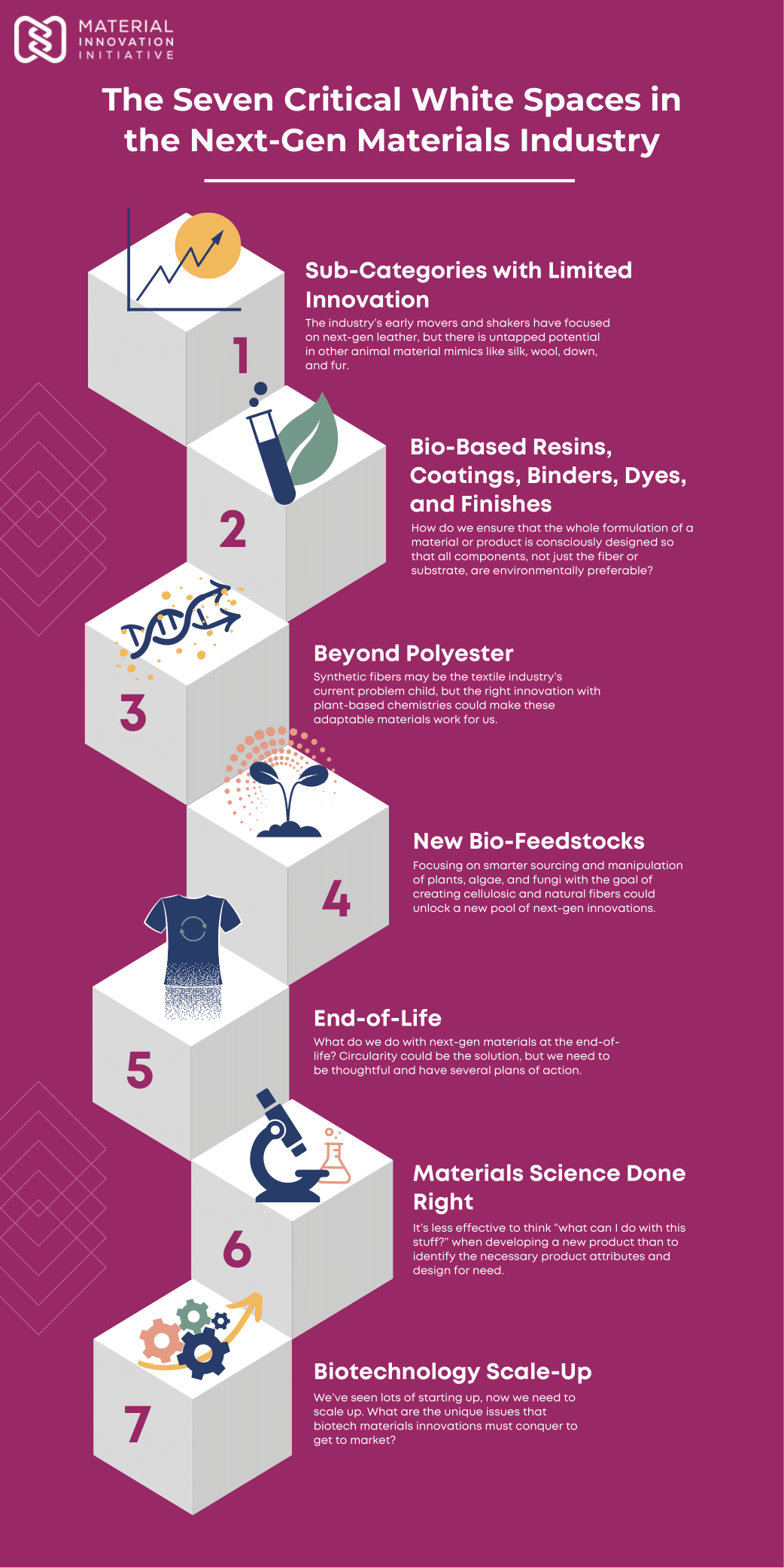

The seven critical white spaces

For our updated series, we are publishing a detailed report on each of the following seven white spaces that we identify as critical to the evolution of the next-gen materials industry:

WHITE SPACE 1: Sub-Categories with Limited Innovation

The industry’s early movers and shakers have focused on next-gen leather, but there is untapped potential in other animal material mimics like silk, wool, down, and fur. Download the report here. Skip to the bottom of this post to discover five key points from the report!

WHITE SPACE 2: Bio-Based Resins, Coatings, Binders, Dyes, and Finishes

How do we ensure that the whole formulation of a material or product is consciously designed so that all components, not just the fiber or substrate, are environmentally preferable?

WHITE SPACE 3: Beyond Polyester

Synthetic fibers may be the textile industry’s current problem child, but the right innovation with plant-based chemistries could make these adaptable materials work for us.

WHITE SPACE 4: New Bio-Feedstocks

Focusing on smarter sourcing and manipulation of plants, algae, and fungi with the goal of creating cellulosic and natural fibers could unlock a new pool of next-gen innovations.

WHITE SPACE 5: End-of-Life

What do we do with next-gen materials at the end-of-life? Circularity could be the solution, but we need to be thoughtful and have several plans of action.

WHITE SPACE 6: Materials Science Done Right

It’s less effective to think “what can I do with this stuff?” when developing a new product than to identify the necessary product attributes and design for need.

WHITE SPACE 7: Biotechnology Scale-Up

We’ve seen lots of starting up, now we need to scale up. What are the unique issues that biotech materials innovations must conquer to get to market?

These hotspots we identified in our 2021 analysis were the key, overarching areas of technical challenge and opportunity within this nascent industry. Nearly three years later, despite burgeoning progress, these white spaces remain active needs in the next-gen industry. In our new report series, we reframe them with updates on notable progress, alternative perspectives, explainers, and external resources to help understand these white spaces further.

Our stance on innovation

Image credit: Werewool

At the MII, we believe in making progress with the goal of perfection. Perfection should not be the enemy of better. We trust that most innovators will rely on the best available options for sustainable formulation components, but completely phasing out less sustainable chemistries and additives is not always easy. MII will continue to identify and explain both opportunities and challenges so that the next-gen industry can iteratively move towards lower environmental impacts.

We believe that:

1) Materials are one solution of many. We should not expect next-gen innovators to single-handedly solve the vast challenges of disrupting the global textiles, chemicals, and additives markets.

2) Performance is key, even over sustainability. Performance and aesthetics are absolute requirements for next-gen products to be successful on the market, and meeting them may initially require sacrifices in certain areas of sustainability.

3) Innovation takes time. The research, development, and scale-up associated with novel, sustainable material feedstocks and chemistries that can be adopted by next-gen innovators takes time and investment.

4) “Perfect” does not exist. There is no such thing as a “perfectly sustainable” material or product.

Image credit: Matthew Smith

“Sustainability is always a series of compromises based on priorities and we need a lot of people doing some things better, rather than a few people doing everything perfectly.”

Dr. Amanda Parkes, PANGAIA’s Chief Innovation Officer

White-gold: the value of white spaces

“Like any blank canvas, white space can provoke fear and hesitation.” But taking on these challenges will enable the next-gen materials industry to deliver on performance and aesthetic and to protect our planet and its inhabitants. We have identified these seven white spaces on behalf of researchers, suppliers, brands, innovators, and investors to clarify where industry-wide efforts should best be concentrated. There will be no silver bullet to solve every problem. We encourage the ecosystem to work together to understand these issues and fill these white spaces with transformative innovation.

5 things to know about white space #1:

- Next-gen leather is crowded, but silk, fur, down, and wool are not: The first report in our series outlines the substantial market opportunities available for next-gen alternatives to silk, wool, down, and fur. With the next-gen market size for these materials currently less than 1%, there is immense room for growth and innovation. We present the total addressable market size for each of these materials in the report, for example, the global silk market is expected to more than double from $20 billion in 2024 to $44.6 billion in 2034.

- With innovation, next-gen materials can outstrip the incumbents: The report provides detailed analyses of how next-gen silk, fur, wool, and down can surpass their traditional counterparts in performance and sustainability. For instance, next-gen down could offer superior insulating properties and better performance in wet conditions.

- Innovators need to hit key creation targets to achieve success, we tell you what those are: New materials must meet specific performance and aesthetic benchmarks to outperform existing animal-based and synthetic alternatives. For example, fabric drape is a desirable component of (next-gen) wool for designers, innovators should look to the incumbent woolens to understand drape.

- Collaboration is paramount for success: Brands, manufacturers, and material innovators must work closely to ensure that new materials meet industry standards and consumer expectations, facilitating smoother adoption and integration into existing supply chains. Manufacturing partners can help troubleshoot things such as tensile strength, crocking, or any other quality control problems.

- Each of the incumbent materials is beloved for a reason: We break down what makes silk, fur, wool, and down so special as materials, highlighting what is unique and valuable about them. For example, silk is the only natural fiber that forms a smooth, continuous filament. This lends it its strength, elasticity and resistance to pilling.

Start your journey into the white space with us as your guide with the first report in our series.

Download our first white space report, on sub-categories with limited innovation, freely available now.